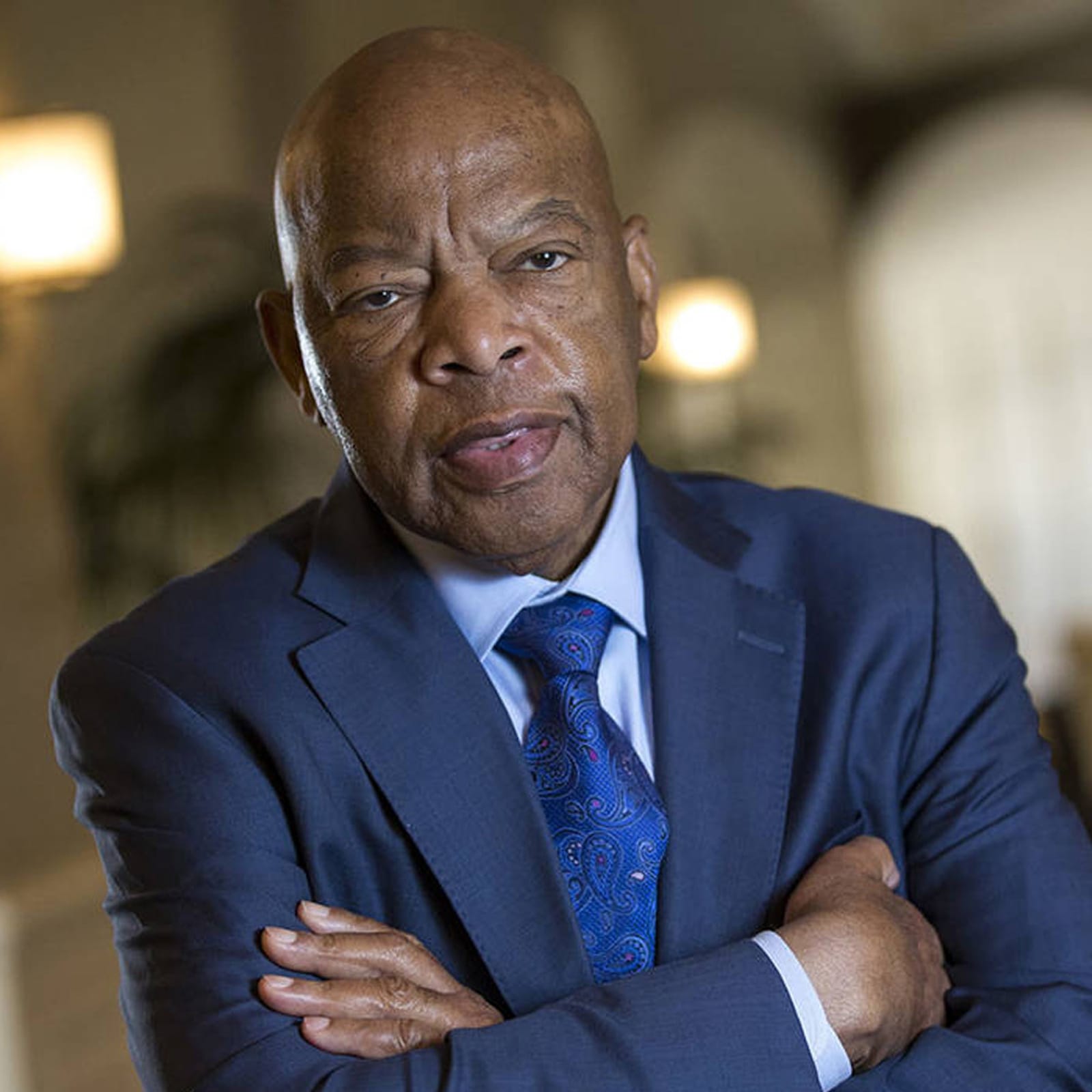

- Truth-Telling Prize Recipient, 2012

- Truth-Telling Prize Recipient, 2012

Whistleblower Eileen Foster, the recipient of the 2012 Ridenhour Prize for Truth-Telling, exposed systemic fraud at the nation’s largest mortgage provider, Countrywide Financial. Her actions go a long way in exposing the fact that fraud on the part of commission-hungry loan officers — not borrowers lying on their loan applications — fueled the increase in toxic mortgages, which in large part gave rise to the 2008 economic crash.

Foster was hired by Countrywide in September 2005. She was rapidly promoted to Executive Vice President in charge of the Fraud Risk Management division, which investigated serious allegations of wrongdoing by company employees.

In 2007, a call came through on the internal fraud hotline from an employee who had been fired from a branch in Boston. The ex-employee had ignored his division’s directive that complaints be handled by their own internal Employee Relations (ER) representatives, and instead called Foster’s corporate fraud hotline. Following up on the tip, Foster contacted the document destruction company responsible for the Massachusetts branches, and asked them to hold off on the shredding until her team had had a chance to examine the paperwork.

What they found was shocking: evidence of loan officers altering and entirely fabricating asset statements and income documentation, even cutting and pasting borrowers’ signatures onto forms they hadn’t signed, and photocopying or faxing the doctored forms so that the changes could not be detected. On speaking with borrowers who had submitted income documentation, they discovered that loan officers would simply switch the borrowers to a no-documentation loan product if their income wasn’t sufficient, and inflate their income for the file. When Foster’s investigators visited the branches, they found cases of Wite-Out just sitting on employees’ desks and file folders of blank bank statements to which borrower names, addresses, and bank balances could be added. There appeared to be no attempt to conceal the rampant fraud.

Thanks to Foster’s investigation, six Massachusetts branches were shut down and 44 out of more than 60 employees were fired or quit.

In an interview with 60 Minutes, Foster said that the fraud “appeared systemic,” and just a way of doing business. “What was going on in Boston,” she said, “was also going on in Chicago and Miami and Detroit and Las Vegas and…Phoenix, and — in all of the big markets, all over Florida.” Despite her findings of equally shocking activities around the country, there is no evidence that Countrywide ever embarked on a full internal audit of their fraudulent mortgages.

By the end of 2007, one third of Countrywide’s loans were in foreclosure. At the time, it was the largest mortgage lender in the country. Countrywide’s way of doing business had led them to the brink of bankruptcy.

In January 2008, Bank of America announced its intention to acquire Countrywide. At the end of the month, all employees were required to complete an annual ethics certification, confirming every staffer’s obligation to report fraud and unethical practices. The certification also reinforced that the requirement that such reports be submitted to the Corporate Fraud Hotline or the Ethics Helpline.

So, almost overnight, the number of internal fraud allegations directed to Foster’s hotline went from roughly nine a month, to more than forty. Foster wondered how many other complaints had been kept from her team. The reports that were submitted had a common theme — those who challenged the fraudulent practices of top-producing loan originators suffered retaliation at the hands of Employee Relations. The very group designated as the corporate employee advocate used its authority to punish whistleblowing employees. Foster delivered evidence against Employee Relations to the internal audit division and asked them to investigate. Executives authorized ER to investigate Foster instead.

Foster’s staff reported to management that derogatory characterizations of her were “jammed down their throat” by ER and they were intimidated into agreeing out of fear of retaliation.

On September 8, 2008 — the same day that her staff was decorating and setting up a surprise potluck to celebrate her birthday — Foster was fired via an 8 a.m. Monday morning telephone call. She was presented with what she calls a “hush money agreement,” which offered her $228,000 in exchange for her silence. She did not sign. Burly men from Bank of America security hovered outside her office while ER took away her badge, keys, and phone.

It took her two years and two months to find another job; she now works at a credit union in California.

On December 5, 2008, Foster filed a Sarbanes-Oxley whistleblower claim against Bank of America, challenging the legality of her firing. Congress passed the SOX Act after the Worldcom and Enron financial fiascos, to protect whistleblowers who report fraud in publicly traded companies. Last September, OSHA (the Occupational Safety and Health Administration agency) ruled that Foster had suffered retaliation in violation of the employee protection provision of the Sarbanes Oxley Corporate and Criminal Fraud Accountability Act of 2002. The Department of Labor ordered Bank of America to reinstate her and compensate her for the wrongful termination.

“I don’t let people bully me, intimidate me and coerce me,” Foster told iWatch News during a series of interviews. “And it’s just not right that people don’t know what happened here and how it happened.”

The silencing of whistleblowers such as Eileen Foster played a key role in allowing the subprime mortgage crisis to reach disastrous levels. The fraud was pervasive at Countrywide, as at many other financial institutions, but there was a structure in place to investigate it. But because Foster was prevented from doing her job — and because no action was taken to follow up on her investigations — the corruption continued unabated, and companies such as Countrywide profiteered on the backs of borrowers.

The lack of robust state and federal laws protecting whistleblowers that expose corporate wrongdoing also contributed to Foster’s plight. In the wake of the financial crisis, these laws have been strengthened. The Dodd-Frank Wall Street Reform & Consumer Protection Act, after much debate and pushback from big business, now provides corporate whistleblowers with an incentive program to report million-dollar wrongdoing directly to the SEC. This law — similar in nature to the federal False Claims Act that recoups billions of dollars each year for the government — appears, at this early stage, to be a successful, secure channel for reports of wrongdoing. In the first two months of the program being enacted — August and September 2011 — the SEC whistleblower office received 334 tips”

More 2012 Prize Winners

One Bold Move, Countless Lives: Empowering Humanity, Changing the World.